Fascination About Frost Pllc

Fascination About Frost Pllc

Blog Article

4 Simple Techniques For Frost Pllc

Table of ContentsFrost Pllc Can Be Fun For AnyoneFrost Pllc - The FactsThe Only Guide to Frost Pllc10 Easy Facts About Frost Pllc ShownSome Of Frost Pllc

CPAs are amongst the most trusted professions, and forever factor. Not just do CPAs bring an unequaled degree of expertise, experience and education to the process of tax obligation preparation and managing your money, they are especially trained to be independent and objective in their job. A CPA will certainly assist you safeguard your interests, listen to and address your issues and, just as important, give you satisfaction.Employing a regional CPA company can favorably impact your organization's monetary wellness and success. A local Certified public accountant firm can help minimize your organization's tax concern while making certain compliance with all applicable tax obligation laws.

This development reflects our dedication to making a positive effect in the lives of our clients. When you work with CMP, you end up being component of our family.

Some Of Frost Pllc

Jenifer Ogzewalla I've functioned with CMP for several years currently, and I've actually valued their experience and performance. When bookkeeping, they function around my timetable, and do all they can to preserve connection of personnel on our audit. This conserves me energy and time, which is very useful to me. Charlotte Cantwell, Utah Festival Opera & Music Theatre For much more motivating success tales and comments from company owner, visit this site and see exactly how we have actually made a distinction for businesses like your own.

Here are some key questions to assist your choice: Examine if the CPA holds an energetic permit. This assures that they have passed the necessary examinations and meet high moral and expert standards, and it shows that they have the credentials to manage your financial issues responsibly. Confirm if the CPA provides services that straighten with your service demands.

Tiny businesses have unique economic demands, and a CPA with relevant experience can offer even more tailored recommendations. Ask concerning their experience in your sector or with businesses of your dimension to ensure they understand your details challenges.

Clarify how and when you can reach them, and if they offer regular updates or assessments. An accessible and responsive CPA will be indispensable for timely decision-making and support. Working with a regional CPA company is even more than simply outsourcing monetary tasksit's a wise investment in your organization's future. At CMP, with offices in Salt Lake City, Logan, and St.

6 Simple Techniques For Frost Pllc

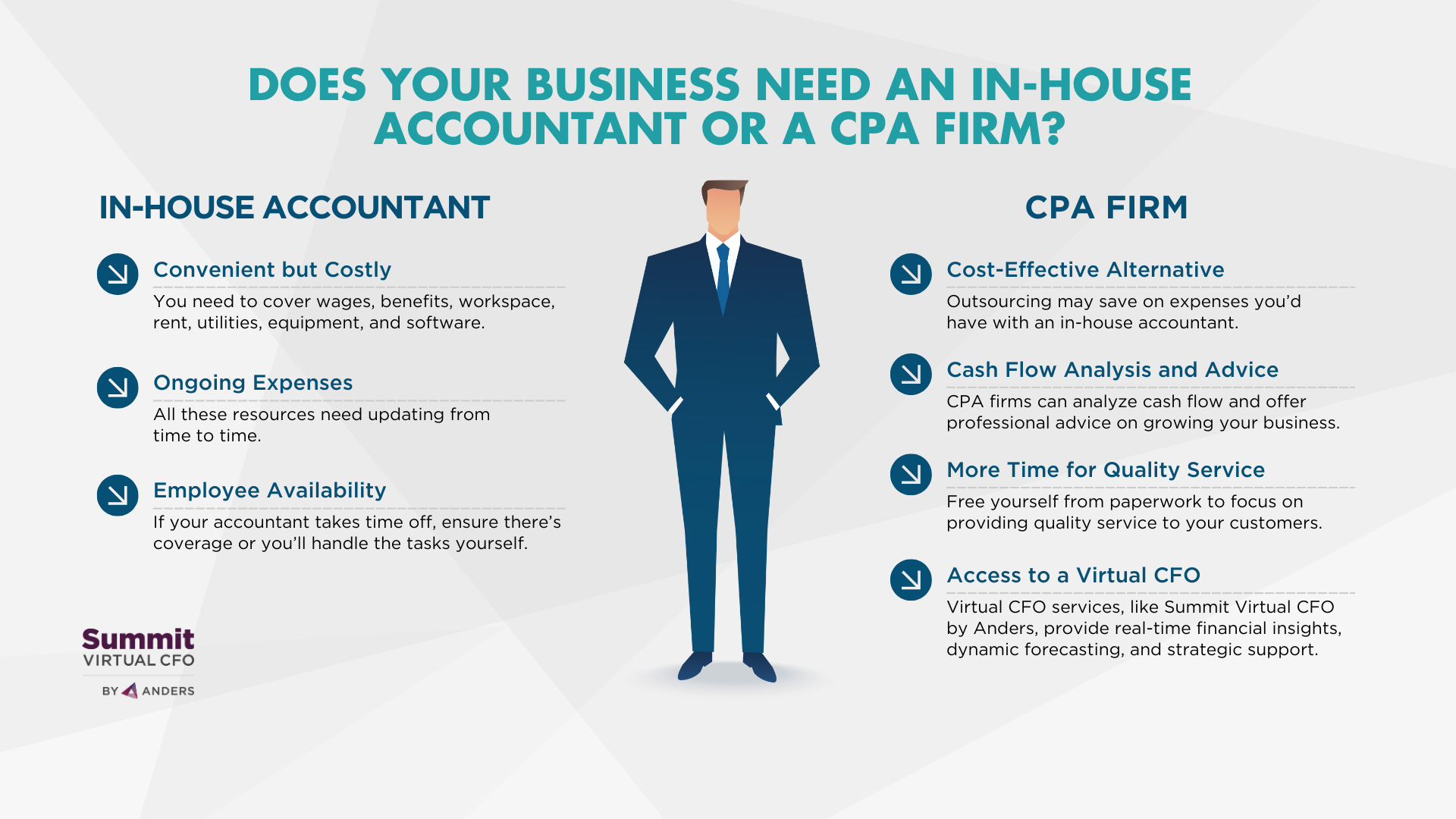

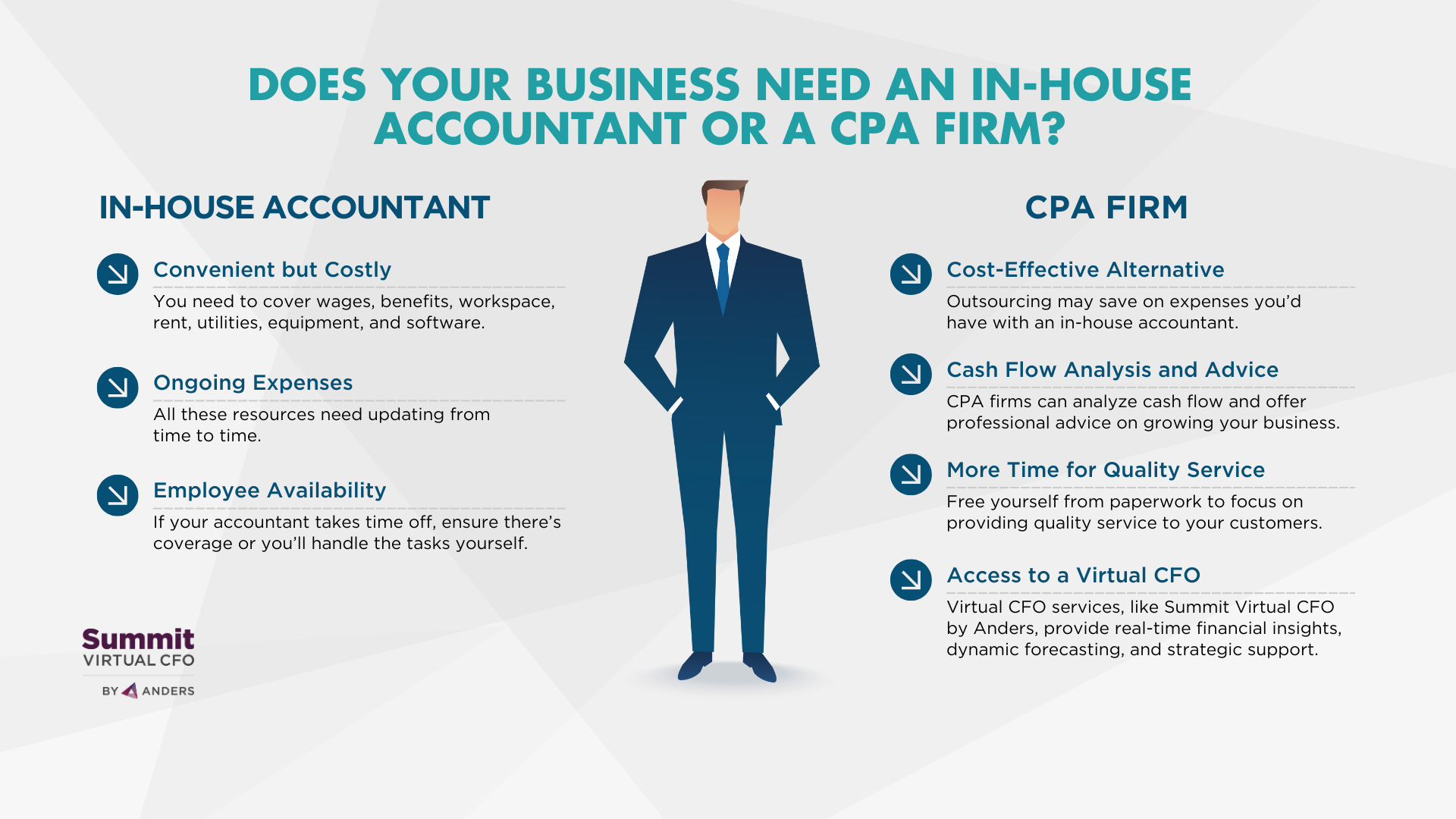

An accounting professional that has passed the CPA exam can represent you before the IRS. Certified public accountants are accredited, accounting specialists. CPAs may help themselves or as part of a company, depending on the setup. The expense of tax obligation prep work might be reduced for independent professionals, however their competence and ability might be less.

records to a firm that focuses on this area, you not just totally free on your own from this lengthy task, yet you likewise complimentary on your own from the risk of making mistakes that could cost you economically. You may not be making the most of all the tax obligation cost savings and tax deductions readily available to you. One of the most essential question to ask is:'When you conserve, are you placing it where it can grow? '. Many organizations have carried out cost-cutting measures to minimize their overall expense, but they have not put the cash where it can assist business expand. With the aid of a CPA company, you can make one of the most educated choices and profit-making approaches, thinking about the most existing, updated tax obligation guidelines. Federal government companies in all degrees call for paperwork and compliance.

The Of Frost Pllc

Tackling this duty can be an overwhelming job, and doing something incorrect can cost you both monetarily and reputationally (Frost PLLC). Full-service certified public accountant firms recognize with declaring needs to guarantee your business abide by federal and state regulations, in addition to those of banks, investors, and others. You might require to report added income, which might need you to submit an income check out here tax return for the very first time

group you can trust. Call us to find out more concerning our services. Do you comprehend the accounting cycle and the actions entailed in ensuring appropriate financial oversight of your organization's monetary health? What is your service 's legal structure? Sole proprietorships, C-corps, S corporations and collaborations are strained differently. The even more facility your earnings resources, venues(interstate or global versus local )and market, the a lot more you'll need a CERTIFIED PUBLIC ACCOUNTANT. Certified public accountants have a lot more education and go through an extensive accreditation process, so they cost greater than a tax preparer or accountant. Usually, tiny services pay in between$1,000 and $1,500 to employ a CPA. When margins are tight, this expenditure might beunreachable. The months prior to tax day, April 15, are the busiest time of year for Certified public accountants, followed by the months prior to completion of the year. You may have to wait to get your inquiries answered, and your tax obligation return could take longer to complete. There is a restricted variety of Certified public accountants to walk around, so you might have a difficult time locating one specifically if you've waited till the last min.

CPAs are the" huge weapons "of the accounting market and generally don't manage daily accountancy jobs. Typically, these other types of accountants have specialties across areas where having a CPA certificate isn't required, such as management accountancy, not-for-profit accountancy, expense accountancy, government accounting, or audit. As a result, using an audit services firm is usually a far better value than hiring a CERTIFIED PUBLIC ACCOUNTANT

firm to support your ongoing financial continuous monetary.

Certified public accountants additionally have knowledge in creating and developing business policies and procedures and evaluation of the useful demands of staffing models. A well-connected Certified public accountant can take advantage of their network to aid the organization in different critical and speaking with roles, effectively connecting the organization to the excellent prospect to fulfill their needs. Following time you're looking to load a board seat, take into consideration getting to out to a CPA that can bring value to your organization in all the means listed above.

Report this page